Key points

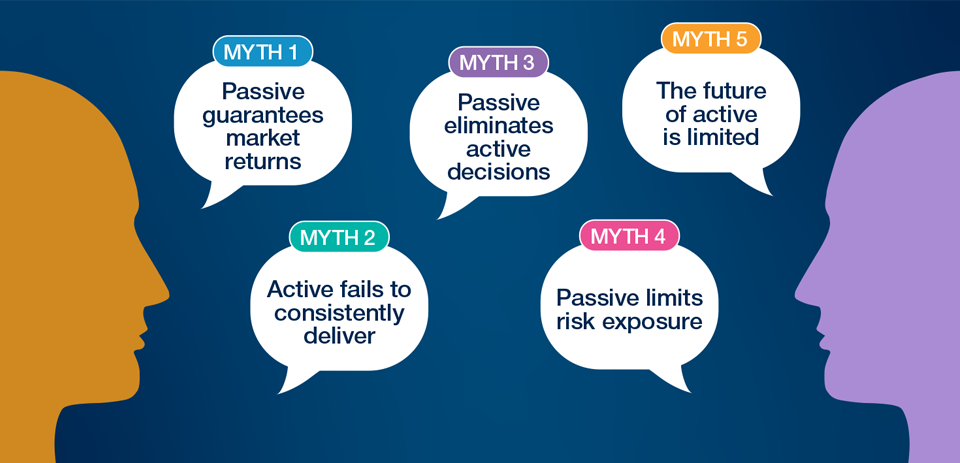

- With so much written about the active versus passive debate over the years, the waters have become muddied, making it increasingly hard to differentiate between fact and fiction.

- U.S. earnings growth estimates may be too optimistic. But we see relative valuation advantages in some equity sectors and in non-U.S. markets.

- Whatever your position, it is only through the “price discovery” achieved by active management that passive investors can be comfortable that markets are efficient and reasonably priced.

The active versus passive debate is a long and passionate one, with proponents of each camp's superiority staunch in their conviction. Certainly, the debate is valid, with research1 showing that "average active strategy" returns fail to consistently outperform comparative index returns. Conversely, passive investing comes with inherent shortcomings, not least being the inability to manage risk exposure, particularly in falling or volatile markets. With so much written about the debate over the years, often from a vehement perspective, the waters have become muddied, making it increasingly hard to differentiate between fact and fiction. In this article, we look to provide clarity on some of the common myths and misconceptions surrounding the active versus passive debate.

MYTH 1: Passive Investing Guarantees the Market Return

Passive investing is usually expressed as buying the whole market. For a passive strategy tracking the S&P 500 Index, for example, it would own all 500 stocks in the same weights that they represent in that index. The appeal of a passive approach is that it is low maintenance, achieving returns in line with the index, minus any costs. In theory, you will never beat the market, but neither will you trail by more than the strategy expenses.

However, the gap between theory and practice can be wide. Consider matching the weights of the different securities in the index. This is not an issue when buying in, but what about when prices change the next day? When does rebalancing take place to keep the weights equally matched? What about when dividend payments are made? How is this new money allocated, and when is it invested? There is a lot more happening beneath the surface of passive strategies than most investors understand, which can have a meaningful impact on returns, particularly over longer‑term periods.

Myths and Misconceptions in the Active vs. Passive Debate

Looking deeper into five common myths

Analysis by T. Rowe Price.

More broadly, passive trading has little impact on market efficiency since it is driven purely by investor flows. In fact, the more assets that are allocated to passive strategies, the more informationally inefficient the markets become. Information‑gathering active strategies, on the other hand, look for, and trade in, stocks that are inefficiently priced. In this way, active management is the essential means by which new, value‑relevant, information is reflected in market prices in a timely way. For markets to remain efficient, and avoid inflated "bubbles" forming, enough funds need to be allocated to active managers.

The generally low‑cost structure of passive investing has obvious appeal. However, investors who choose an investment purely on this basis must understand that, in doing so, they are guaranteed to underperform the index, year in, year out. It is true that many active managers also underperform their comparative indices, and at a higher cost. However, skilled active managers can and do regularly beat comparable passive returns. High‑quality managers that invest significantly in research; follow a disciplined process; integrate environmental, social, and governance considerations; have access to company management; and charge reasonable fees have shown that they can, in fact, consistently capitalize on information inefficiency in the market and benefit from periods of pricing dislocation.

Moreover, with more complex index tracking strategies becoming available, the promise of low‑cost passive investing does not always ring true. Some of the newer exchange-traded fund products that track younger, and less liquid indices, for example, are charging more than some actively managed funds. At the same time, the fees being charged by some active managers have come down considerably over the past decade, in direct response to the significant flow of assets being allocated to low‑cost passive strategies.

This post was funded by T. Rowe Price

Important Information

For professional clients only. Not for further distribution.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

© 2022 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.