The COVID pandemic and the subsequent recovery continue to distort the economic data, forcing economists who rely on traditional recession signals to continually revise their assumptions. As a result, the most anticipated global recession in history has become the most delayed recession in history.

To be sure, there are reasons for caution regarding the global economic outlook.

Europe looks likely to endure stagnant growth in early 2024 before recovering in the second half. In Asia, China's economic outlook remains gloomy, with few signs of improvement in the country's property market. Commercial real estate sectors remain fragile in several other countries as well.

Meanwhile, the U.S., Japan, and Europe are at different stages in the balance between growth and inflation, meaning the Fed, the European Central Bank, and the Bank of Japan (BoJ) are likely to pursue increasingly asynchronous monetary policies in 2024, adding to the potential for increased market volatility.

Geopolitical uncertainty also could bring further volatility, particularly if conflicts in the Middle East and Ukraine cause a resurgence in energy prices. Recent election victories for far‑right populist candidates in Argentina and the Netherlands raise the question of whether further wins for populist parties could occur elsewhere, especially in the U.S., where the November 2024 election will be the most consequential currently known political event of the year.

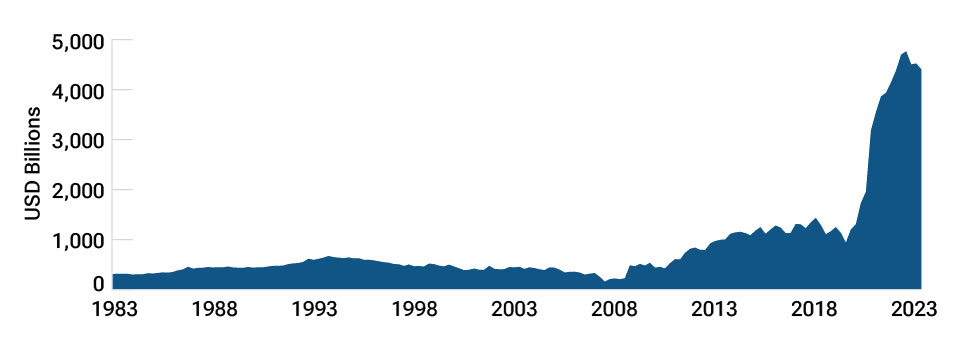

As of late November 2023, most global economies were showing surprising resilience to higher rates (Figure 2), and the U.S. economy was performing better than expected. The unprecedented levels of cash generated by pandemic support and other fiscal stimulus measures have been a key support for U.S. household and corporate balance sheets. Excess consumer savings should continue to provide support for U.S. economic growth going forward (Figure 3).

Major global economies have shown surprising resilience

(Fig. 2) Real GDP growth at 2010 prices

As of September 30, 2023.

Sources: U.S. Bureau of Economic Analysis, Statistical Office of the European Communities, Cabinet Office of Japan/Haver Analytics. T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved.

U.S. consumers are still flush with cash

(Fig. 3) Checkable deposits and currency holdings of U.S. households

As of June 30, 2023. Source: U.S. Federal Reserve Board.

Consumer spending has been the most resilient driver of growth, due to the strength of the US labour market. At the end of September 2023, there were 9.6 million open jobs available for the 6.4 million unemployed workers in the U.S. labour force

This post was funded by T. Rowe Price

Important Information

For professional clients only. Not for further distribution.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

© 2023 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.