Key points

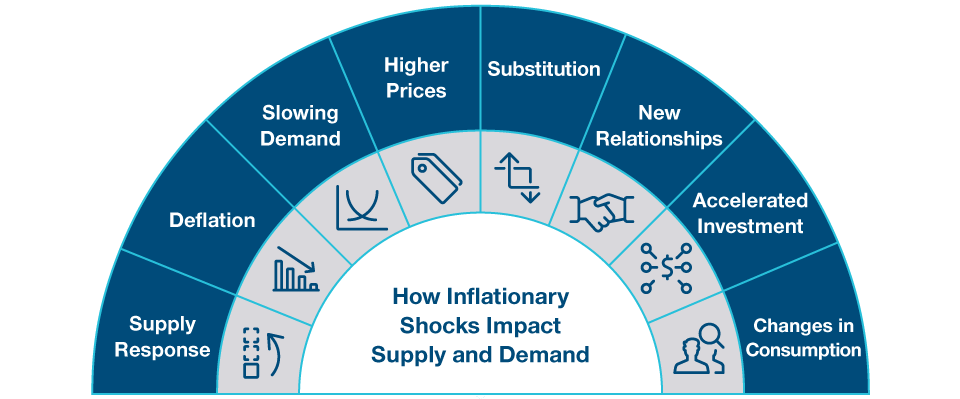

- Inflationary shocks such as Russia’s invasion of Ukraine have almost always led to deflation through the subsequent supply response and the slowing of demand.

- Idiosyncratic stocks offer solid upside potential—even in this challenging environment.

- After the rotation we have seen over the past 12 months, we are not overly concerned about a value factor headwind.

Inflation is driven by the intersection of supply and demand. Before COVID‑19 entered our lives, it was clear that supply exceeded demand in many parts of the world—and there was little impulse for strong inflation. We had lots of energy, lots of labor, and not enough growth. Technology was unlocking capacity in every sector, which had a deflationary effect. Add to this the fact that there were changing demographics—with decreasing populations—and large amounts of debt, and it is clear why generating inflation was a challenge for the global economy.

A "Shock on Top of a Shock"

Russia‑Ukraine conflict creates further complexity

For Illustrative Purposes Only.

The global spread of COVID‑19 had a huge impact on demand and supply. On the demand side, the U.S. Federal Reserve took extraordinary measures to stabilise the global economy, lowering the fed funds rate to 0% and rolling out massive monetary stimulus to support a global economy that would otherwise have faced serious problems. The Fed effectively backstopped risk. Private equity, venture capital, cryptocurrencies, and hyper‑growth technology companies received unprecedented flows of capital. Extreme valuations emerged for the most speculative areas, and these are now unwinding—putting pressure on growth stocks. Elsewhere, governments transferred cash to private sector savings and investment.

This post was funded by T. Rowe Price

Important Information

For professional clients only. Not for further distribution.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

© 2022 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.